Event: #Nudgestock, Folkestone, UK, Part I

If you know me in IRL, or follow my twitter before yesterday, you may be aware that my current degree programme is two-pronged; data analytics, as explored on this blog, and decision sciences, both of a psychological and electronic means. Yesterday I was pleased to indulge the latter by attending the #Nudgestock conference, organised by Ogilvy Change, in Folkestone, Kent. It was a superbly thought-provoking event with research and practice in behavioural economics, and the brainchild of Rory Sutherland, wearer of many big hats at Ogilvy, a man of three TED talks and an extremely capable public speaker. Ogilvy's Change arm, which was co-founded by Sutherland, was one of the first advertising agencies to hit the ground running on behavioural economics in the UK outside of academia.

This was a fairly dense conference so I will be splitting the post in three pieces, firstly commercial (which has a shorter half-life in the grand scheme of things) and subsequently those which focused on creativity and then academic. Many thanks also to design thinker Binit Vasa, my seat neighbour on the day who provided me with a lot on interesting conversation and insight on the event, having known Sutherland personally and come all the way from India (I thought Leeds was bad!) for the event.

Sutherland opened with a skit (it was so funny you probably could not call it much else) on the myopic nature of economics and what he has coined as the "South London Problem", which is the general observation that when presented with a model, solutions to a problem in that space suddenly shrink to only those within the model - taking the tube map as an example, a person surveying a problem and presented with this model, would probably completely misunderstand the its nature due to the tube being almost entirely north of the River - any solution would actually miss the majority of London's population, which live south of it. Flavours of his speech can be found from his books and TED talks, one of which I've inserted below and if you do nothing else, I recommend you watch this;

https://embed-ssl.ted.com/talks/rory_sutherland_sweat_the_small_stuff.html

After a joyously amusing introduction including a (failed) nudge to ensure the event runs on time (entirely aimed at Sutherland), the first speaker was Robert Colvile, a journalist who has recently published a book on the pace of life, or particularly, its acceleration. Simple premise, easy to understand - most people would agree that the pace of life seems to be accelerating, and his example included the disruption caused by mobile phones, as well as interesting insights such on the social nature of how we pace our lives. His talk ranged over quite a wide variety of subjects including the notion that we seem to take pessimism as a guide to intelligence, that relative pace in circumstances of change may be a guide to political disillusionment and the future of urbanisation in the developing world, the latter of which was disputed by the audience quite hotly. Colvile was certainly interesting and insightful but twenty minutes is probably not forgiving for his subject - I also found the lack of mention to previous 'pace' accelerations, of which I can think of at least four (farming; printing press, industry, globalisation) somewhat myopic, but perhaps that's why there's a book on the subject and not just the 20 minute talk.

[youtube https://www.youtube.com/watch?v=WdkgBlOt8m0]

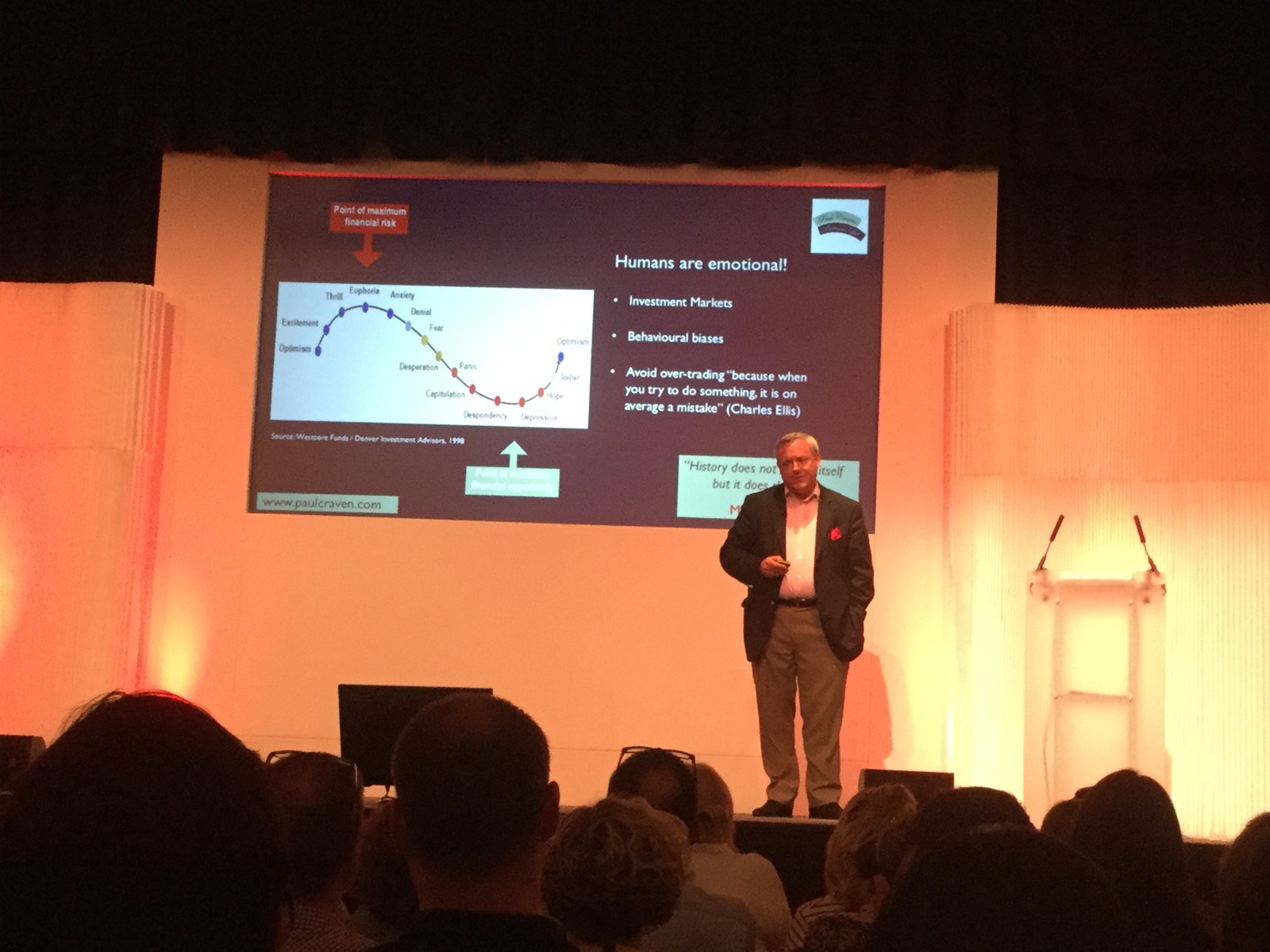

The next commercial speaker was Paul Craven, coming from the field of financial investment which was, surprisingly, a field I felt more comfortable with than advertising. His talk focused on pareidolia (seeing patterns, most often faces, where none exist) and the tension in investment between luck and skill. This was focalised through The Loser's Game, by Charles Ellis, which as investment and life advice makes the salient point that it's more important to avoid losing than picking the winner. The best investors minimise their mistakes and play a long game, rather than the current trend of picking 'a winner' and (hopefully) lucking out on them - because that's what a significant part of ones winnings would be, luck. I can certainly see the link to Prospect theory and the notion of reference points, with negatives twice as painful as positives are pleasant, as well as the work of Thaler and Benartzi, the latter of whom Craven acknowledged. The later point that such an attitude needs self-discipline to maintain, in order to resist the urge to maximise one aspect and get nailed with hidden costs in a vector one did not perceive (which is a limitation that foils machine-based decision aids) I also considered very thoughtful. His whole speech made me think it should be compulsory viewing for voters in democracies, as the notion of picking a winner or avoiding a loser is surely the 2016 US election in a can. On his twitter, I also found out that Craven was a member of the Magic Circle, which must give him a very interesting perspective on how humans minds can be tricked.

This is post 1 of 3, the latter of which shall be following over the next couple of days.